Featured products

-

Ettore Master Replacement Squeegee Rubber (Dozen Pack)

Regular price From $18.26 USDRegular priceUnit price per -

Ettore Master Replacement Squeegee Rubber (Gross Pack)

Regular price From $325.00 USDRegular priceUnit price per -

Ettore T-Shaped Replacement Squeegee Rubber (Dozen Pack)

Regular price From $42.00 USDRegular priceUnit price per -

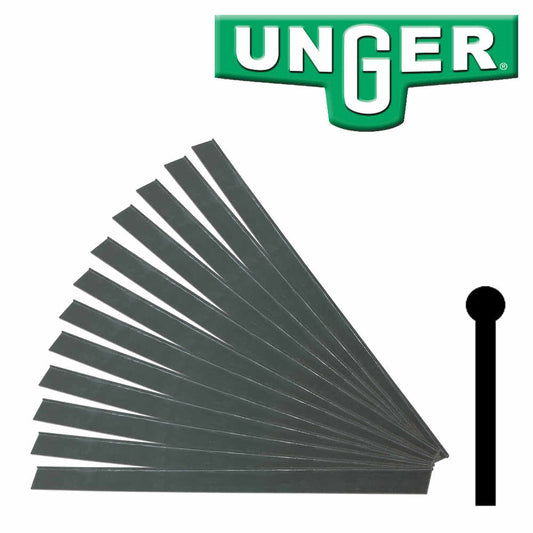

Unger Green Power Replacement Squeegee Rubber (10-Pack)

Regular price From $50.60 USDRegular priceUnit price per -

Unger ErgoTec Replacement Squeegee Rubber (Dozen Pack)

Regular price From $21.06 USDRegular priceUnit price per -

Unger ErgoTec Replacement Squeegee Rubber (Gross Pack)

Regular price From $348.64 USDRegular priceUnit price per -

Unger HARD Replacement Squeegee Rubber (Dozen Pack)

Regular price From $37.01 USDRegular priceUnit price per -

Unger HARD Replacement Squeegee Rubber (Gross Pack)

Regular price From $368.64 USDRegular priceUnit price per

QUALITY WINDOW CLEANING PRODUCTS. TRUSTED SERVICE.

We value the relationships we build with our customers over years of service and consultation. Give us a call at 1-800-535-6394 if you have questions regarding anything we sell and we'll be happy to give you advice about the right equipment for your company.

Best,

Mike @ Detroit Sponge